·Niko Laamanen · blog · 8 min read

The Hidden Plunder: Unveiling the Devastating Effects of Inflation

Understand the destructive power of inflation. Discover the consequences of central planning, theft, declining wages, and rising inequality. Break free from a broken system with the orange pill.

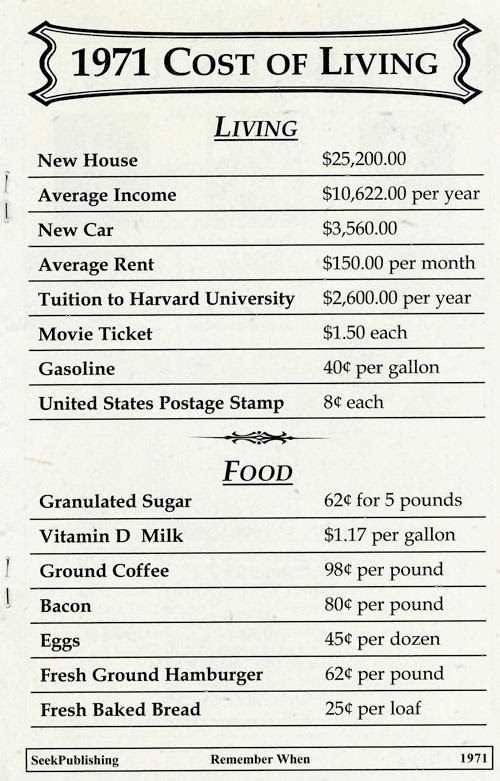

Is it normal to have two or more jobs and still not make enough to live on? No? Why could our grandparents afford a house on a single income without selling themselves to decades of debt slavery? If you read on, I will tell you a true story of heinous plunder. Spoiler alert: you are the victim.

Being a millionaire (of any fiat currency) is no longer impressive. In 10 years, millionaires will likely be common.

Over time, all fiat currencies will go to zero. The euro’s purchasing power has fallen by about 85% in 20 years (compared to gold), and the pound sterling (the longest-running fiat currency) has lost 99.5% of its value. It’s no coincidence that no one wants to save in a debt-driven economy.

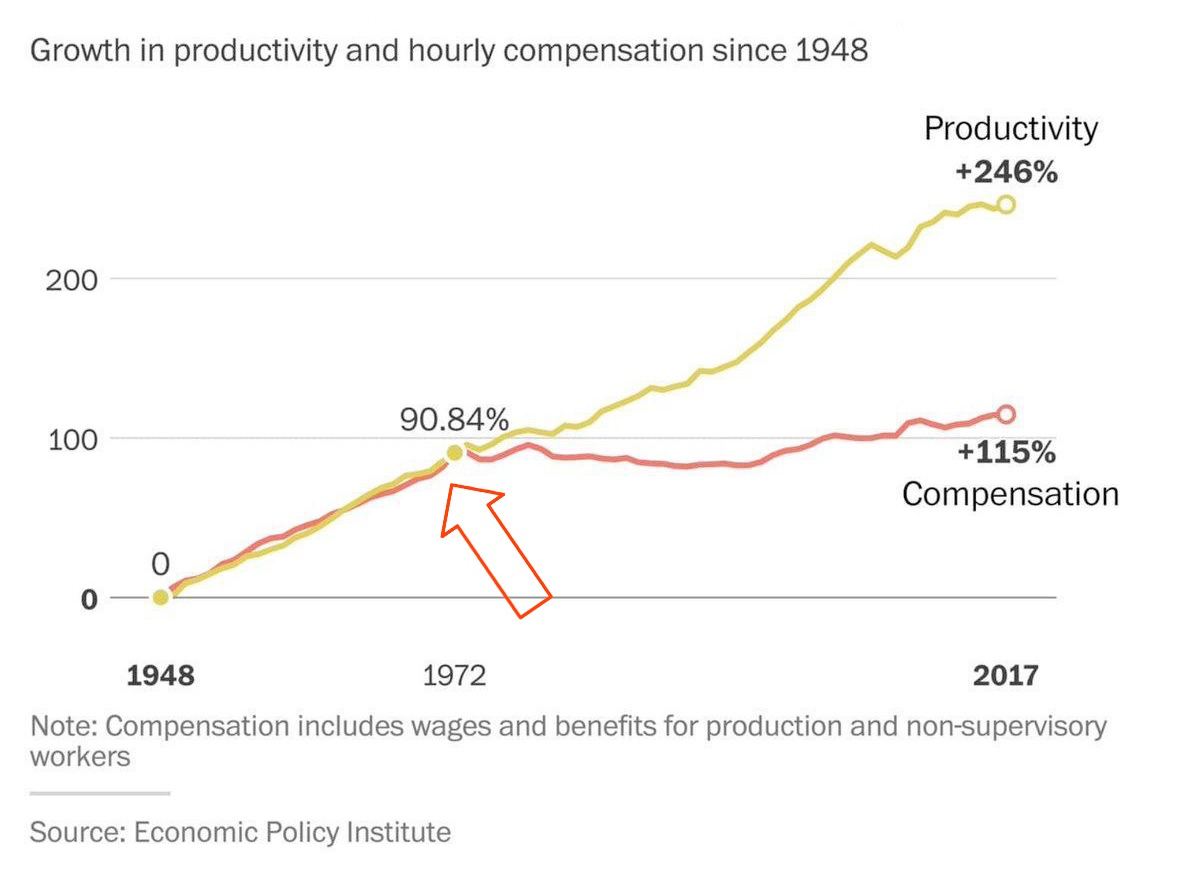

After Richard Nixon discontinued the convertibility of banknotes into gold in 1971, money creation became a tool of plunder, wreaking havoc on wages. It’s an intriguing coincidence that human productivity has increased linearly since 1948, but the salary increase took a tangent in 1971.

The global leaders made three main mistakes in 1971:

-

To allow the USD to become the world’s reserve currency,

-

let commercial banks control the reserve currency, and

-

concede control of nearly all consumer goods supply chains to mega-corporations owned by the money-makers.

Of course, none of the items on the list would have happened in a hard money standard (gold standard) would have been maintained. Unfortunately, keeping the gold standard was no longer a viable option in a world that was globalizing fast with the rise of the information age on the horizon.

Contrary to what you may believe after consuming the lies spewed by propagandists (who work for the top 1% wealthiest elite), capitalism is not to blame for this bait-and-switch, but rather central planning, also known as socialism.

Socialism was invented as a tranquilizer for the restless masses, no longer content with their wages, unable to sustain comfortable lifestyles by the fruit of their labor and the sweat of their brow. Blaming rich, greedy, and selfish capitalists is an easy way out. It offers little accountability for the poor individual lacking the means to prosper in a game of life that had its rules re-written by the un-elected upper class who put themselves in charge of billions of souls for profit. No. Capitalism is not greed or selfishness; those characteristics stand on their own. Capitalism is best defined as an economic system that:

-

Protects private property

-

Enables capital accumulation

-

Promotes free and voluntary trade

-

Respects individual means of production

-

Emphasizes division of labor to maximize profits

Anything less than complete freedom in choosing what money you decide to use, what you choose to buy, and with whom you choose to trade is better described as socialism. Taking away your mojo and giving it to someone else is more commonly known as theft.

Fiat currency, “the fun coupon,” is the main tool of global enslavement. There is no need for whips and chains anymore when peddling elaborate stories of the “greater good” makes people enslave themselves and to even pay for their upkeep!

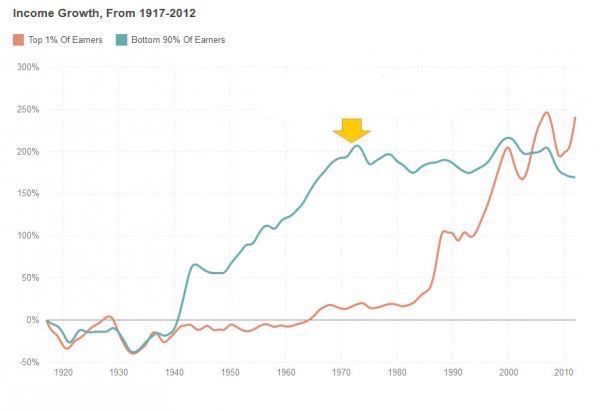

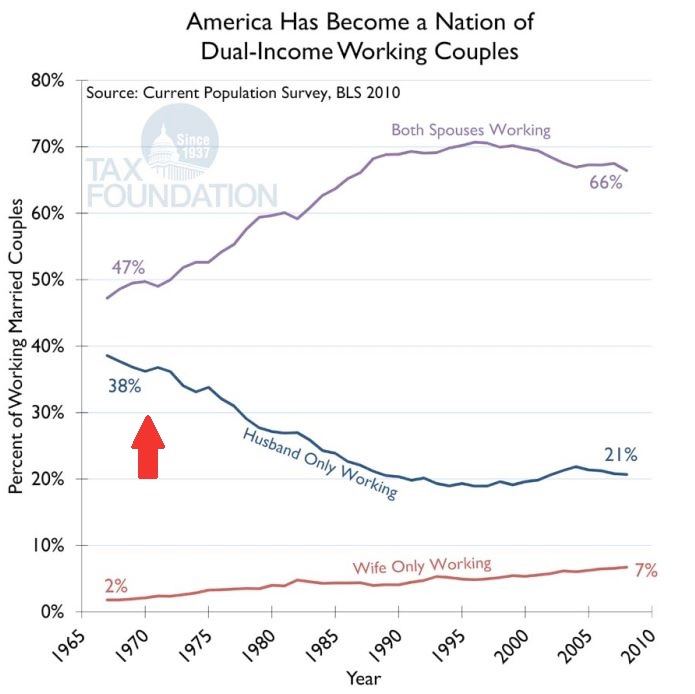

How would you better explain why, ever since 1971, wages of the bottom 90% of earners have gone sideways while the top 1% have rocketing wages? Fascinating, absolutely fascinating. (Graph 2)

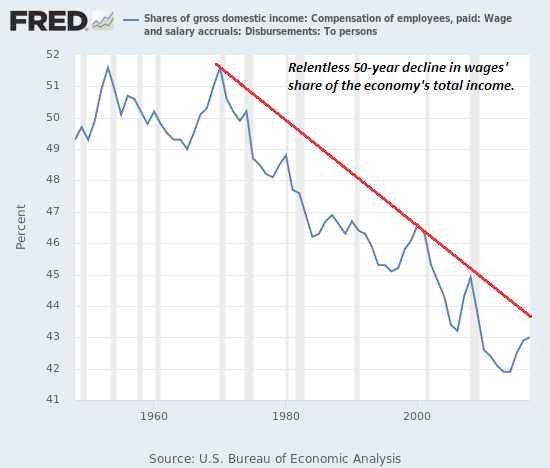

Wages compared to gross national income have been on a steep decline for the past 50 years. How come? Could it be that workers are producing less? Of course not, as we can see from graph 1: Productivity is rising, wages are falling.

If your wages don’t rise to the inflation rate, you get a pay cut yearly. How much is inflation, then? The “official truth” (as of 2022) is 7%. But ask yourself: what’s the reality if that’s the publicly reported figure? My estimate is at least 20% annual inflation. Does your salary increase by 20% (or even 7%) annually?

Inflation has an interesting consequence: if you get a loan at an interest less than 7% per annum, it’s certainly worth taking out a loan and investing in something productive or converting to hard (to produce) money for saving. No wonder the economies of all countries are debt-driven today: debt equals money.

Let’s look at some more data, shall we?

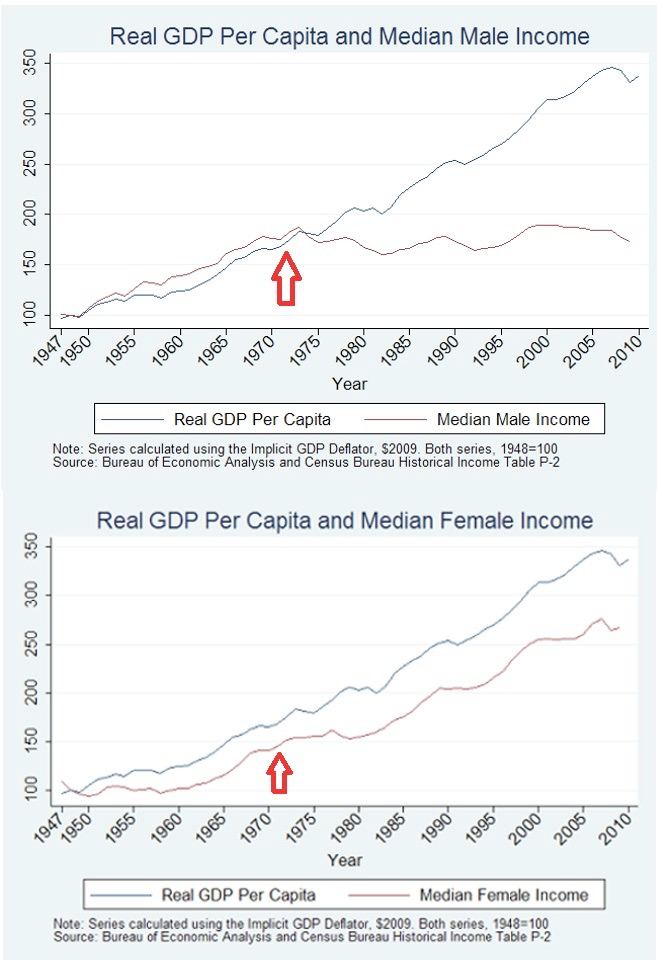

There seems to be a clear difference in wage growth between men and women. Could the rise of intersectional feminism explain this? Down with the patriarchy?

Nope. Female wages are increasing because it has become normal for both parents to have careers and run for their lives in the ever-spinning hamster’s wheel. Fiat money is the culprit, and females are not being empowered, but human civilization is being enslaved.

How does this sound to you: 40 years of slave labor to increase someone else’s wealth, after which you get a gold watch for being a “good worker,” then in the third year to your retirement, you die of meaninglessness, having wasted your whole life working for someone else. No? That’s because it’s a terrible idea. Saving up for freedom hasn’t been an option for most of us for a very long time. So long that only a few are alive to remember how it was to live under a hard money standard. The gold standard.

In the ’70s, you could have worked hard, saved for 3-4 years, and bought a house in cash. Nowadays, it’s normal to take out a 30-year mortgage to buy a million-dollar house that is smaller and of worse quality than the houses sold in the 70s. Too bad for your children that, in the worst case, inherit your mortgage, not to mention inheritance and property taxes. Wow.

It’s mind-boggling that the mantra “inflation is good for the economy” has become a widely accepted truth with almost no contest. Ask yourself: from whose point of view? The 1% or the 99%?

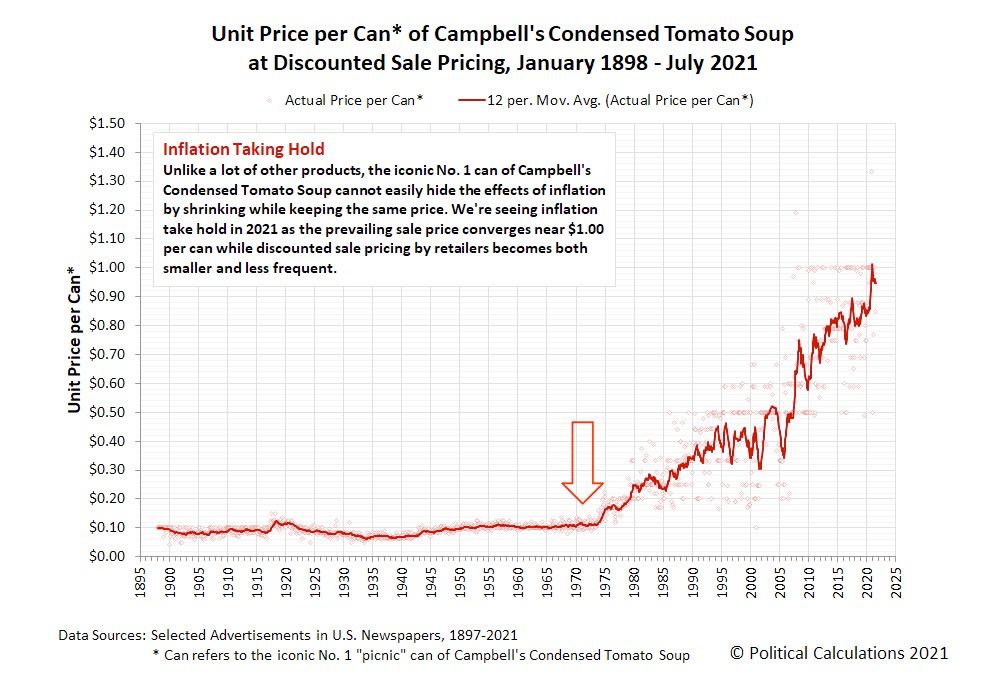

“But inflation keeps the prices constant.” Oh, really? Let’s zoom out and look at the classic Campbell’s canned tomato soup price development. Has the quality of the soup increased? Have technological advances made it more expensive to produce tomatoes or find minerals to fabricate cans? Or is the price increase only explained by monetary inflation, the deliberate decimation of purchasing power?

In 2021, 80% of all existing USD in circulation was conjured from thin air. What will happen when the effect of monetary base inflation is slowly passed on to consumer prices? You can see the impact everywhere through higher gasoline and other commodity prices. Even food prices are going up while portion sizes are being reduced. This clever trick is called shrinkflation, which means you’ll get half the amount for double the price (spread over a long enough time), and voilà: inflation stays hidden, at least from all but the most vigilant observers. Half a pint is not the same as a full pint. The Big Mac Index is a well-known tool for analyzing global price developments. Still, it doesn’t consider shrinkflation, the deceptive cousin of inflation.

Most of us need to be made aware of why no work seems enough to secure a life of freedom. Most of us roll over and choose the life of self-slavery because it is the “normal” thing to do, the “adult” thing to do. The reason we are easily persuaded by the lie of “common good” and self-sacrifice is that we are not taught about the difference between hard money and easy money in school. According to the doctrine passed down in 1971, there is government-issued, sanctioned, and acceptable money (all code for easy money). Every living person has a right, no, a duty, to be aware of the biggest hoax ever pulled on mankind: centrally issued, inflationary currency that should not even be called money. It has not earned the title.

Granted, many people benefit or feel they profit from the current fiat monetary system, which is why the concept of “the welfare state” is perilous. Any involuntary wealth transfer ends up ultimately in the net negative because taking money from the productive to give it to the unproductive causes inactivity and, ultimately, poverty. Of course, it’s tempting to be promised free money by staying home for 50% of what you would get if you did hard work. That’s why politicians who promise the most free lunches are voted into office time after time.

In truth, money is a tool of trade that emerges from the free markets composed of countless individuals. We, as individuals, can choose our money based on what works best for us. Works. For. Us.

The hardest money to produce is the rational option because it holds value and can’t be arbitrarily inflated to kingdom come. Gold was the hardest money for millennia due to its atomic qualities, but we now have an even better option. You may have heard of it. It’s called bitcoin, and it is the last, best hope of humanity to shed the chains of eternal slavery and become masters of our destiny.