·Guilherme Bandeira · blog · 25 min read

All good monies are alike; each bad money is bad in its own way

As soon as the spot Bitcoin ETF was approved by the SEC in January this year, I wrote here about this important step for the institutional adoption of Bitcoin in the United States, also addressing the short- and long-term risks involved with this type of financial product. Now that, unexpectedly and through political pressure, the SEC has also approved the spot Ethereum (ETH) ETF, I will go into detail about how I believe the competition between these different ETFs will play out in the market.

As soon as the spot Bitcoin ETF was approved by the SEC in January this year, I wrote here about this important step for the institutional adoption of Bitcoin in the United States, also addressing the short- and long-term risks involved with this type of financial product. Now that, unexpectedly and through political pressure, the SEC has also approved the spot Ethereum (ETH) ETF, I will go into detail about how I believe the competition between these different ETFs will play out in the market.

The narrative about what Ethereum is and what its network is for is always changing, as are its protocol consensus rules and monetary issuance rules. I have read that the network represents a supercomputer, a decentralized internet, and a platform for financial innovation. According to the latest update made by Vitalik and his team, it now functions as a tokenized platform that validates its blocks and compensates part of its users through the proof-of-stake (PoS) mechanism. For all practical purposes, the Ethereum network constantly issues new tokens (ETH) — 70% of which have already been pre-mined by its developers — and these tokens can be exchanged by its users to pay for different applications. After this latest update, much like a bank in the fiat system, if you have enough ETH tokens, you can stake part of them through the staking mechanism, earning more ETH through the process of validating new blocks. This process issues more units of ETH that did not previously exist, a perpetually and randomly inflationary mechanism since we do not know how many ETH will someday be issued or if these rules will remain in the future.

Described this way, ETH tokens present themselves as candidates for native monetary assets of the internet. Therefore, despite different narratives, when comparing Bitcoin and Ethereum, in the end, we are navigating the old theme of monetary competition, where various monetary goods compete for broad adoption and dominance.

In addition to Ethereum, it is likely that the regulatory agency will also approve similar ETFs in the future for this class of assets, which are mistakenly sold as “crypto-assets”. However, if market conditions are free, the winner will take it all, and the winning money too: in this competition between Bitcoin and the various tokens that will be in these funds, Bitcoin will be dominant, as it has indeed been dominant in the non-institutional retail competition before being packaged as financial products by large institutions. As demonstrated in the chart below by Rafael Zagury, CIO of Swan, 95% of the tokens launched on the market since 2016 have lost value compared to Bitcoin. The vast majority, 5,175, do not even have a price today and have been a total failure:

Could the SEC’s green light give some life to tokens like Ethereum, Solana, or Dogecoin?

Many are familiar with the opening of Tolstoy’s famous novel, Anna Karenina:

All happy families are alike; each unhappy family is unhappy in its own way.

With this phrase, Tolstoy meant that for a marriage to be successful, it must possess different attributes together, such as physical attraction, shared principles of child-rearing, religion, friendly relatives, and other fundamental issues. The failure of any one of these essential attributes can ruin a marriage, even if it has all the others.

Tolstoy touches on something profound. We err when we seek one-dimensional explanations for success based on just one isolated attribute. For vital matters, we need to avoid many possible specific causes of failure. The “Karenina principle” has high explanatory power and can be extended to understand many other important things in life beyond marriages. It can even explain the evolution of money up to Bitcoin. Historical forms of failed money, like shells, limestone and fiat, failed for different reasons, and it was not by chance that we converged to precious metals like silver, gold, and now Bitcoin, which possess many similar attributes together. The adaptation of the “Karenina principle” to our monetary history would be something like:

All good monies are alike; each bad money is bad in its own way.

I’m not the first to expand the Karenina principle beyond the domain of marriages. My inspiration came from reading the classic Guns, Germs, and Steel and seeing how Jared Diamond used the “Karenina principle” to explain why only a few candidate animals for domestication were actually domesticated and why humanity specialized in domesticating large terrestrial mammals.

Indeed, what we today call civilization would never have arisen among Eurasian peoples without the domestication of these types of animals since large terrestrial mammals were extremely important to the human societies that possessed them. This activity largely determined the survival or not of certain human groups. Those who were successful in domesticating them would have more meat, fertilizers, land transport, leather, assault military vehicles, traction, wool, milk and its derivatives and would also, of course, create natural immunity to germs that killed people who had not previously been exposed to them.

Described this way, the advantages seem obvious when we look at a cow, a sheep, or a pig, and it is not difficult to see why the societies that managed to domesticate these animals prospered. But why have many species of seemingly docile wild large mammals, such as the zebra and the antelope, which would be great candidates for domestication, never been domesticated, while others, like the cow and the pig, have?

If the definition of “large” is “weighing more than 37 kilos,” the world has only 148 species of large wild mammals, herbivores or omnivores, that could be candidates for domestication. And large mammals are important because the size of these animals brought enormous comparative advantages for those who adopted them. Small animals like chickens, guinea pigs, rodents, weasels, and chinchillas, of course, had their importance. But none of these small beings pulled plows or chariots, none carried riders, none except dogs pulled sleds or became war machines, and none were as important for food as the large domesticated mammals.

The great enigma is why, out of these 148 species, only 14 were domesticated before the 20th century. This indicates that only a small number of factors determine whether an animal is capable of being domesticated. Why, in this important competition, did the other 134 species fail? And even so, considering their global importance, of these 14 species, only 5 main ones spread to practically all peoples: sheep, goat, cattle, pig, and horse — the remaining 9 became important only in limited parts of the globe: the Arabian camel, the Bactrian camel, the llama/alpaca, the donkey, the reindeer, the buffalo, the yak, the Bali cattle, and the mithan (gayal).

Given humanity’s universal propensity for domestication, the failure to domesticate certain animals is due to deficiencies in the attributes of the species themselves, not the ancient humans. The puzzle lies in the unquestionable dominance of so few species, not in us. The answer, according to Diamond, follows the Karenina principle. To be domesticated, a candidate wild species must possess many different attributes together. The absence of any of the mandatory attributes compromises domestication efforts, just as it compromises attempts for a happy marriage.

Diamond identifies six reasons for domestication failure: diet, growth rate, problems with breeding in captivity, nasty disposition, tendency to panic, and social structure. I will briefly explain each of them here, following Diamond’s reasoning:

Diet. Whenever an animal eats a plant or another animal, the conversion of food biomass to consumer biomass is usually around 10%. Therefore, it takes approximately 5 tons of corn to support a half-ton cow. To raise a carnivorous animal, it would take an incredible 5 tons of herbivorous animals, which themselves would need 50 tons of corn for food. It would be a huge waste of energy and time. Thus, no carnivorous mammal has been domesticated to reliably serve as food for humans; we have only selected herbivores.

Growth Rate. But not all herbivores. For it to be worthwhile, domesticated animals need to grow quickly. This eliminates gorillas and elephants, although they are herbivores, have a lot of meat, and are relatively easy to feed. No one would wait 15 years for a herd to reach adult size. We need large herbivores with a fast growth rate.

Breeding Problems in Captivity. Just like humans, many species that could be very useful to us do not like to reproduce under the watchful eye of strangers. For this reason, animals like the vicuña, a type of wild camelid from the Andes that has very valuable wool, have not been domesticated. Despite strong incentives for its domestication, vicuñas cannot breed in captivity. They have a long and complicated courtship ritual before mating, something that doesn’t happen when they are confined to a restricted area. Large herbivores with a fast growth rate need to reproduce easily in captivity.

Nasty Disposition. Almost every large mammal species can kill a human. Many people have been killed by pigs, horses, camels, and cattle. But some animals have even worse temperaments and are much more dangerous than others. The tendency to kill humans has disqualified many seemingly ideal candidates for domestication. This is the case with the African buffalo. It has all the other attributes: it is herbivorous, grows quickly, has no problem breeding in captivity, but it is very dangerous, which prevented its domestication. Other not-so-obvious examples are the zebra, onager, moose, and Asian wild ass. The temperament of these animals is terrible; they are irritable and tend to bite people. Large herbivores with a fast growth rate need to reproduce easily in captivity and not be prone to killing or biting humans.

Tendency to Panic. Large mammals react to predator danger in different ways. Some immediately run away, while others are slower and seek protection in herds. Deer generally belong to the first type; sheep and goats to the second. The gazelle, for example, although heavily hunted, has never been domesticated because when in captivity, it panics, trying to escape and either dies or manages to jump almost nine meters and run at 80 km/h. Large herbivores with a fast growth rate need to reproduce easily in captivity, cannot be hostile to humans, or try to escape desperately when captured.

Social Structure. Animals that do well in herds maintain a hierarchy of dominance among members. This way, herds can occupy the same pasture instead of exclusive territories. There are no fights, and everyone knows their place within the hierarchy. Humans can domesticate them because they take over the leadership in the dominance hierarchy. Humans become the leaders, and the herd can be guided by a shepherd or herding dog, and the animals do well in crowded pens because they also tend to stay together in the wild. Territorial animals, like big cats, do not follow humans. Deer and antelopes do not have a well-defined social hierarchy, which prevented their complete domestication. Large herbivores with a fast growth rate need to reproduce easily in captivity, cannot be hostile to humans, attempt desperate escapes, and must also have a social structure favorable to living in large herds.

These attributes together solve the mystery of the apparent arbitrariness with which so few species have been domesticated and not others, often close relatives. The fact is that all other candidates for domestication were eliminated by the Karenina principle, with various species failing along the way for different reasons. Humans and most animal species were an unhappy marriage for one or more possible reasons: diet, growth rate, mating habits, tendency to panic, and various distinctive social organization characteristics. Only a small percentage of wild mammals achieved happy marriages with humans, thanks to the compatibility of these attributes, and this greatly favored Eurasian peoples over others.

I propose that for another fundamental question, that is, which monetary good to choose, one can apply the Karenina principle to also explain the apparent arbitrariness with which some goods performed well as money and others did not. Some goods formed a happy marriage with humans to serve as money and the rest failed for different reasons. The appearance of arbitrariness in the choice of these goods made many people think that money is simply a “social construct” or a collective illusion, and that anything can be money, just by wanting it or some authority deciding by decree. But our economic history is different. Just as in the domestication of large mammals, repeated exchanges between humans selected for only some goods to be used as money and others not. And, as in the history of large mammal domestication, those who correctly chose the best monetary goods benefited enormously.

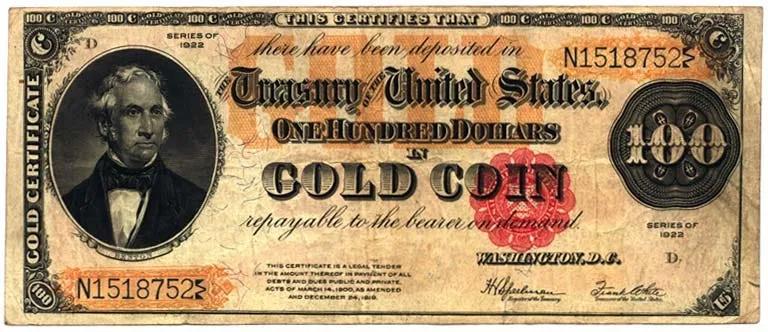

We know that various goods have been candidates for money in human history. Objects like shells, bone fragments, salt, cattle, glass beads, limestone, copper, silver, and gold have been used as money by various peoples around the globe. But these objects never worked equally: if a better money was introduced and economic conditions were free, over time the superior form of money would be adopted and the inferior form discarded (for a more in-depth explanation, see my article on the correct interpretation of Gresham’s Law). This is why forms of primitive or proto-money, such as wampum shell necklaces used as money in North America by Native Americans before the English arrived, do not circulate today in the United States or Canada. Until the arrival of Bitcoin, in this millennial process of selection through countless repeated exchanges over time, gold was the natural element that best served as money, and we only know the different forms of primitive money from anthropological and historical accounts. This was not a random process. It occurred because good money is that which serves to transport value over time and space, and for this to happen, there are attributes that something needs to have together: divisibility, portability, fungibility, durability, verifiability, and high stock-to-flow rate. I will explain each of them here and why only the good that has these characteristics together forms a happy marriage with us in the form of money:

Divisibility: Indicates whether the good can be easily divided into smaller parts. To store value in space and time, we need a good that is easy to divide and count. Only a highly divisible good can function as a unit of account, allow economic calculation and facilitate exchanges. Few things in their natural state are easily divisible in this manner. Even gold in its natural state is not easy to divide, which is why we resorted to coinage to assign approximate units of weight, such as grams or kilograms. Despite this, for small values, gold was never the ideal currency for division, which is why a bimetallic standard was adopted in many places until the 19th century, using gold for larger values and silver and copper for smaller ones. Low divisibility excludes many assets that, although valuable, do not function well as money. Real estate, for instance, although used as a store of value by many and monetized in the fiat system, is not easily divided into small parts. If someone wants to buy a motorcycle, it is not possible to sell a few square meters of an apartment to pay for it; the whole apartment must be sold, causing distress to those needing to sell quickly in times of financial need. Historically, cattle was a strong candidate for currency; in fact, the terms “pecuniary” and “pecunia,” another name for money, come from “pecus,” meaning cattle in Latin. Despite this association between cattle and money, cattle suffered from poor divisibility, especially for small values. In monetary history, this problem diminished with the advent of coinage and the improvement of banknotes and bank ledgers. This allowed gold to be kept in vaults and circulated as banknotes representing only fractions of the gold deposited in banks, improving its divisibility, even though it represented gold credit rather than the gold itself. Bitcoin’s divisibility is not an issue since each Bitcoin is subdivided into 100,000,000 sats, facilitating economic calculation in many small parts. When Bitcoin becomes global currency, one could still, in second or third layers, stipulate sub-sats if necessary. Tokens competing with Bitcoin today are also easily divisible, a benefit of the dematerialization of money that facilitates its numerical abstraction into identical parts.

Portability: This attribute assesses the costs of carrying and transporting the good. It’s not enough for money to be divisible; it also needs to be portable so someone can carry it and facilitate economic exchanges wherever they go. With poor portability, a good simply cannot function to transfer value over space, hindering economic exchanges and its use as money. All physical goods carry some portability cost, and this was another significant advantage of money’s dematerialization: considerably reducing portability costs. Although gold functioned as the best money for millennia, it has a high transportation cost. Imagine buying a book on Amazon today and having to mail fractions of grams of gold as payment. This is totally unfeasible for contemporary commerce. For very high values, gold’s portability worsens significantly, as its value is measured in weight (grams or kilos), and no sane person would walk around with gold bars in their car to pay for a property. It was gold’s poor portability that led to its centralization in banks and subsequent confiscation and demonetization by governments worldwide. Theoretically, fiat money has good portability, especially for small values. A small banknote or coin is enough to pay for a “coffee at the coffeshop”. The major problem with fiat’s portability is that for higher values, its portability is very restricted, even prohibited in some countries. If someone carries many banknotes in their pocket, many questions are asked by state agents. Try sending a significant amount to another country and see the numerous fees, controls, and permissions required. The SWIFT system is still very slow, expensive, and inefficient, usually taking days to confirm a single international transaction. Bitcoin’s superiority over other monies considering this attribute is immense. To carry and transport Bitcoin, you only need to keep your private keys and know how to sign transactions on mobile phones or computers. No need to ask anyone for permission. Portability is like a password that someone can even carry in their mind. For low values, the second-layer Lightning Network works instantly and with reasonable fees. For very high values, Bitcoin fees are negligible. It is common to see billion-dollar transactions paying only a few dollars in fees for transactions that take only a few minutes to confirm, something unimaginable in the fiat system. In principle, the main tokens competing with Bitcoin generally have reasonable portability, but most lack sufficient liquidity to be accepted on some exchanges or by individuals. Among the tokens with higher market value, I’ve read many reports of problems with the Solana network, which is so unstable that it needs to be paused numerous times. The Ethereum network suffers from high transaction fees due to how they are calculated in its PoS system.

Durability: This attribute refers to the degradation of the good over time. Goods that degrade easily over time are terrible for storing value simply because they lose their properties. No one thought of using fruits as money because after a few days they are rotten. The good must endure to store value over time. This favored precious metals, especially gold, which is practically indestructible. Fiat, on the other hand, can degrade in two ways: physical banknotes can suffer from the effects of time (it’s not a good idea to bury notes in the yard to leave for your grandchildren), but also the value of fiat money can deteriorate due to actions by the issuing authority (How much is a Brazilian Cruzado note worth today?) and cease to be accepted. This makes the vast majority of fiat currencies have very limited durability — the average lifespan of a fiat currency is only 27 years. Since Bitcoin is dematerialized, it will exist as long as nodes are running its software. Bitcoins do not degrade over time because they exist as decentralized records in its timechain. Bitcoin units can be “lost” if someone forgets their private key or sends them to a wrong address. However, they cannot be destroyed like a physical good can. Other tokens competing with Bitcoin are also immaterial, they are records on computers. However, as they are not decentralized, their durability can be compromised because the servers of those who control the network can be shut down. They are durable as long as the developer team is willing to keep the servers running.

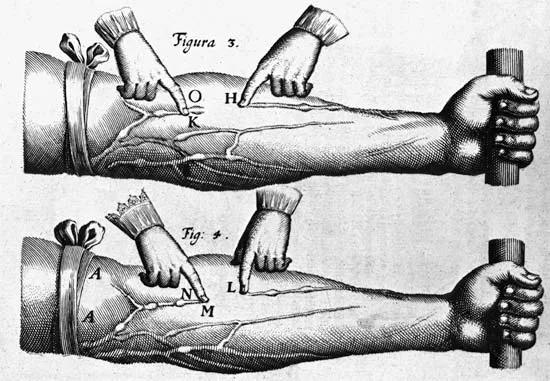

Verifiability: This attribute refers to the ease and costs associated with verifying the authenticity of a monetary asset. During the metallic standard, verifiability was a constant problem, as money clipping and debasement were very common practices, either by authorities or common people. The designs on the faces of coins and the ridges on their edges were invented to prevent clipping and ensure the amount of grams described on the coin matched its metal content. For higher values, this problem persists. It is very costly to verify if a gold bar is actually gold or another metal like tungsten. Equipment like a spectrometer can be used, but even it has flaws and is very costly. The safest way to verify the authenticity of a gold bar is to melt it down and recast it entirely, a very time-consuming and expensive process. Modern fiat currency notes have been developed to prevent counterfeiting. They have watermarks to verify their authenticity but are still counterfeited. Modern bank records and payment methods offer a more efficient, albeit decentralized, way to verify payments and transfers. Nevertheless, it is common, especially in Brazil, to hear about cases of theft and fraud, which is why final settlement of bank transactions takes a few days. Bitcoin’s verifiability is excellent because it is validated by cryptographic proofs. If you run your node, you can be sure those records are valid, it is impossible to counterfeit, and it is very cheap to verify yourself. Moreover, Bitcoin ownership does not depend on any political authority. It is attested by the system itself. In this regard, tokens competing with Bitcoin are very similar to fiat currency: they have good centralized verifiability. Both systems require a high degree of trust in third parties who do all the verification for you.

Fungibility: Following its legal definition, fungible goods are those that can be replaced by others of the same kind, quality, and quantity. This is a very important element for exchanges and for the existence of money because it creates the possibility of equality and equivalence between different units of a monetary asset. If an asset is unique, like a Tintoretto painting, it is not fungible because there will simply be no other of the same kind, quality, or quantity in the world. Grains of salt, on the other hand, are very fungible. Gold and silver, if coined or divided into bars, are also very fungible. However, what many do not realize is that, even being a matter of degree, fungibility is something attributed by economic agents themselves and not an intrinsic attribute of the asset. Strictly speaking, nothing is exactly equivalent to another. Even a grain of salt is microscopically different from another grain of salt. Even two banknotes of R$10 have different serial numbers, although we attribute the same value of R$10 to both and treat them as equivalent. I say this because Bitcoin, while favoring fungibility (each satoshi in the form of UTXO is an integer number associated with an address), also has a custody history recorded in the timechain. There are recent and nefarious efforts to try to diminish Bitcoin’s fungibility, either through chain analysis, which tries to “mark” satoshis associated with certain addresses for control authorities, or by a recent invention called “Ordinals theory,” which arbitrarily assigns an order to each existing satoshi. Both are spurious attempts to end Bitcoin’s fungibility and diminish its monetary function. Competing tokens with Bitcoin also possess a high degree of fungibility, as they are records on centralized servers, but they can also be “marked” in various ways.

Stock-to-Flow Rate. The stock-to-flow rate is not just about the increase in the number of units of a currency or simply a metric to measure how scarce something is. The scarcity rate measures the relationship between the stock and the flow of the supply of a good to assess its ability to maintain value over time. The stock is the existing supply, consisting of everything that has been produced in the past, minus everything that has been consumed or destroyed; and the flow is the extra production that will be made in the next time period. If people choose a strong currency as a store of value with a high scarcity rate, this decision will cause an increase in its price, which will encourage its producers to create more units of it. But since the flow is small compared to the existing stock, even with an increase in new production, it is unlikely to significantly depress the price. On the other hand, if people choose to hold their wealth in a weak currency with a low scarcity rate, it will be trivial for the producers of this good to create large quantities of it, which will depress its price, devalue the good, expropriate the wealth of savers, and destroy its ability to maintain value over time. Saifedean Ammous, in the book “The Bitcoin Standard,” calls this problem the easy money trap: anything used as a store of value will increase its supply and anything adopted as money whose supply can be easily increased will destroy the wealth of those who use it as a store of value. The scarcity rate is a reliable indicator of how well something will function as money because, even when used as money and a store of value, it will be difficult to dilute purchasing power by arbitrarily increasing the flow of new supply. I will use the famous example of Rai stones on the Yap Island to explain this point. Until the arrival of Europeans, these limestone had a high scarcity rate because it was difficult to increase their supply on the island, and their stock was large among the inhabitants who used them as money. When new units were easily brought by boat from neighboring islands, the inhabitants of Yap suffered high inflation because the scarcity rate of Rai stones plummeted abruptly: new stones were brought every day to the island at a minimal cost. Over time, Rai stones were completely demonetized because they no longer served as a store of value. In the millennia-old monetary competition, gold was the natural element that best served as money because its scarcity rate is superior to all precious metals. Since it is practically indestructible, the supply of gold accumulated over the centuries while it was difficult to increase its supply. From cattle to salt, to shells, to metals and precious metals, we have constantly progressed, moving to harder money, which allows us better ways to store value over time. This culminated with gold becoming the only money in the world at the end of the 19th century, with an annual supply growth of approximately 2%. Now with Bitcoin, for the first time in history, humans have a form of money whose supply increases by less than 1% per year. 94% of all Bitcoin that will ever exist has already been mined, leaving only 6%. Bitcoin not only allows us a form of money outside of government control but also has the highest scarcity rate that has ever existed, making it the most advanced form of money of all time, even better than gold. No matter what happens, you can be sure that your Bitcoin will never be diluted by more than 1% per year. Bitcoiners often emphasize that Bitcoin has absolute scarcity. As long as Bitcoin continues to exist, that will be its monetary supply. Competing tokens with Bitcoin may present themselves as scarce. However, because they are centralized and constantly alter their monetary supply, this scarcity will always be relative and not absolute.

These six attributes together solve the mystery of the apparent arbitrariness with which some goods were monetized throughout human history. Just like with large mammals, all other historical candidates were eliminated by the Karenina principle, with various types of money failing along the way for different reasons. Humans and various objects had an unhappy marriage for one or more of the following reasons: divisibility, portability, fungibility, durability, verifiability, and low stock-to-flow rate. These are the reasons why I technically believe that Bitcoin will continue to monetize relative to other assets and tokens that are used as money today. And it won’t be the approval of a new ETF that will change this history.

If you are interested in all the possible futures bitcoin might help develop you should buy your own copy 21 Futures!