·Guilherme Bandeira · blog · 2 min read

Bitcoin and germs, or how central banks practice economic phlebotomy

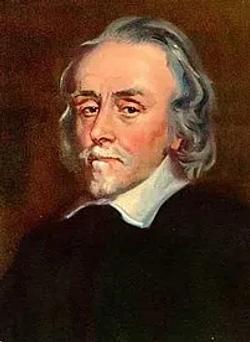

William Harvey demonstrated the mechanism of blood circulation in the 1620s, demolishing ancient and medieval knowledge about the body’s humors.

William Harvey demonstrated the mechanism of blood circulation in the 1620s, demolishing ancient and medieval knowledge about the body’s humors.

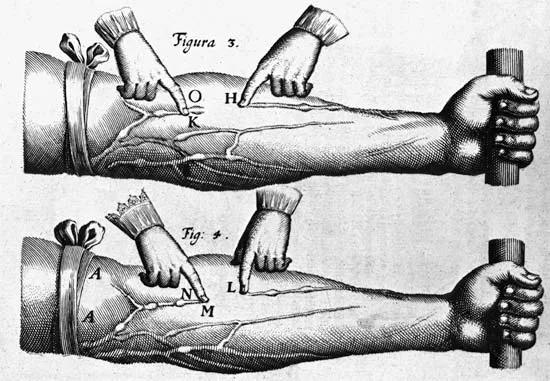

However, Harvey’s discovery did not stop doctors from continuing to prescribe strange and ineffective practices such as phlebotomies (bleeding) and poultices (applying a piece of damp bread or cereal to inflamed tissue).

These treatments developed even after Pasteur, in the 19th century, demonstrated that germs were causes of infectious diseases.

Let’s put things in perspective: only 200 years after germs were discovered to exist was it widely accepted that they also caused disease; it took 30 years between the theory of putrefaction and the development of asepsis; there was a 60-year difference between asepsis and drug therapy.

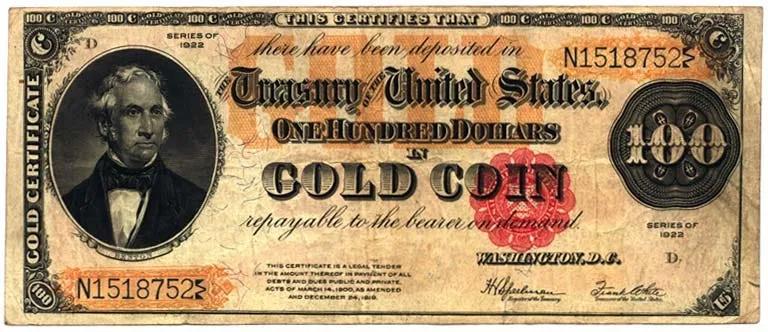

The 20th century has already demonstrated that Central Banks did not “stimulate” the economy. On the contrary: help kill it. When we inject credit into the system by printing fiat money and generating inflation, we practice economic phlebotomy.

Putting more blood into the patient will not restore health. Some members of the body become bloated with blood while the rest sicken and rot.

It is human nature that old practices take time to disappear. Few want to compromise their jobs and reputations in the name of change.

It is often necessary to wait for an entire generation to die (or for a war to happen) for a new paradigm to be accepted.

Bitcoin is just over 15 years old. It is in its infancy. Let’s be patient.